Have you ever caught yourself staring at the clock and praying for the workday to be over? Do you fantasize during the workday about the next vacation you’re going to take when your work gives you more days off? What about tossing and turning on a Sunday night in dread of returning to your workplace the next day?

If you have experienced any of these scenarios then chances are that you would be very interested in the FIRE movement. The FIRE movement is a relatively new mindset that people are adopting to help them quit the rat race earlier and start living a more fulfilling life.

Whether you are an avid follower of FIRE or are just hearing about it for the first time, this article will examine everything you need to know about the FIRE movement and financial freedom in Canada.

What is the FIRE movement?

If you are not familiar, the F.I.R.E. movement is a financial mindset that stands for “Financial Independence Retire Early”. Followers of the FIRE movement are very interested in achieving financial freedom and regaining control over their life. For this article, when we say “financial freedom”, we mean that you are no longer dependent on income from a full-time job or from other people to support your lifestyle.

The phrase FIRE was first popularized in the 1992 book “Your Money Or Your Life” by Vicky Robin and Joe Dominguez, which has over a million copies sold. The authors argue that if you work for a salary or hourly wage then every time you pay for something you are really just paying with hours of your life. For example, if you earn $15/hour and spend $150 at the grocery store then you have technically paid 10 hours of your life to purchase those groceries ($150 / $15 per hour = 10 hours). A casual lunch including tip? That might cost you one hour of your life.

Once you adopt this mindset, you will begin to change the way that you view your expenses and financial health in general.

According to search data from Google Trends (see below), the term FIRE has been growing since 2011.

Usually, when you think of people who are financially free or “retired early”, you probably conjure an image of famous athletes/entertainers, business owners, or people who come from money. Your mind jumps from people who live a standard working-class life to those who are very wealthy. However, there is an entire segment in between these two classes of people. This class of people no longer has to work all day in order to live but they are also not necessarily ultra-wealthy. This class is where followers of FIRE reside.

The FIRE movement is not a get-rich-quick strategy or a business plan designed to make you a billionaire. Instead, it is a strategy that’s meant to be achievable by almost anyone. It is built off of two simple pillars:

- Saving – If you want to retire at 35 instead of 65 then you will need to supercharge the amount that you are saving each month. For most people, this means saving about 70% of their income.

- Living frugally – To achieve such an incredible savings rate there is almost always a huge emphasis on living frugally. Followers of FIRE usually take pride in living frugally just as fitness junkies take pride in eating healthy and exercising. Both parties realize that they are making a sacrifice now in order to reach a long-term goal.

The most common end goal of “Financial Independence, Retire Early” is (you guessed it) to retire early! Instead of saving a small percentage of their income and retiring at 65 (or older), people who follow FIRE want to save a huge percentage of their income and cut their timeline for retirement in half. That being said, early retirement doesn’t necessarily have to be your end goal. “Financial independence” is a wide-reaching goal that can mean a lot of things.

Is FIRE for you?

Followers of FIRE are usually trying to achieve financial independence. Again, the generally accepted definition of financial independence is that you have enough investment – or passive – income to pay for your living expenses without having to be employed or dependent on others.

Once you either have enough saved or earn enough passive income to meet your living expenses, you are officially financially independent and will not have to work ever again. The thing is…some people like to work. Is retiring a necessity of FIRE?

Before you start pursuing FIRE, we would recommend thinking long and hard about the following questions:

What is your end goal? Assume for a moment that you have already achieved great wealth and do not need to work. You have already bought everything that you could ever want and have enjoyed a few years of living without the need to work. What would you do with yourself then?’ What type of lifestyle would bring you happiness assuming that money was no object? This is the type of life that you should be working to build through FIRE.

Are you prepared for the sacrifice? To be incredibly fit and in shape, you will need to work out and eat healthy almost every day. For some people, being fit is well worth the sacrifice of working out and not eating junk food. However, plenty of people would much rather eat whatever they want than be fit. The same is true for financial independence. Some people want to be financially free so bad that they are willing to survive on a minimalist lifestyle for years before reaching their goal. However, some people might not mind their job and would be much happier by spending every dollar that they own. There’s nothing wrong with either mentality, just be sure that FIRE is something that you actually want. Having said that, living the FIRE lifestyle is a spectrum. And depending on your goals and values, you can tailor it to suit your needs. While there are many ways to pursue FIRE, these are the three most popular:

What type of FIRE do you want to follow?

- LeanFIRE – You are content with living a minimalist life (spending $25,000 or less) in order to save as much as possible. Even in retirement, you plan on living modestly.

- FatFIRE – You want to save up several million before you are comfortable retiring so that you will have plenty of money to spend living life on your own terms.

- BaristaFIRE – You have saved enough to retire early but still choose to supplement your income by working on something that you’re passionate about.

Which of these sounds like your speed? The more thought you put in at the beginning of the process, the more clear your journey will be!

So once you’ve pondered these questions, how do you actually go about retiring early?

How do I retire early?

If FIRE is something that you know you want to start then there are a few simple steps to get you ready for the road ahead.

Save, save, save – As mentioned, the FIRE lifestyle usually has an intense focus on frugality. This means putting away as much as 70% of your income to be saved. In order to do this, you will need to rethink most of your lifestyle. Things that you used to consider necessities will suddenly be cut out. However, after a few weeks, you will adjust to this new way of living and it will simply be your normal. A good way to get started living on this path is to save 50-70% of your income from every check that you get. Set up an instant transfer so that every time you get a direct deposit that money is transferred to your investment account. Physically transferring this money will force you to live on a reduced income.

Invest, Invest, Invest – It is imperative that you transfer this money into some type of brokerage account instead of just a savings account. This is because savings accounts generate almost 0% in interest. On the other hand, most investment accounts will allow your money to grow at a rate of 5-10% each year. Over time, this can be the difference between retiring 35 or 45.

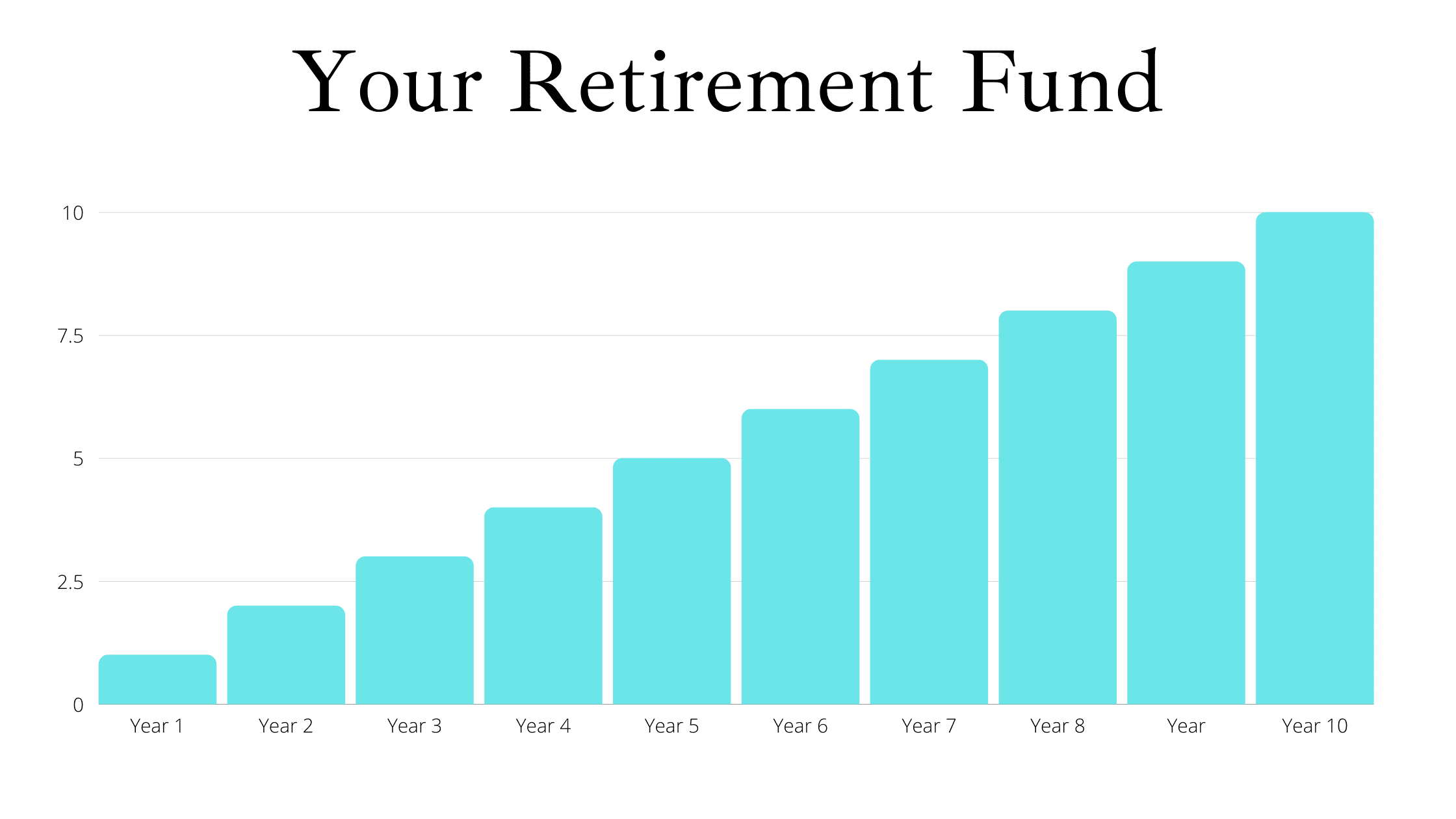

If you only save money (and don’t invest it) then your retirement fund will grow linearly like this:

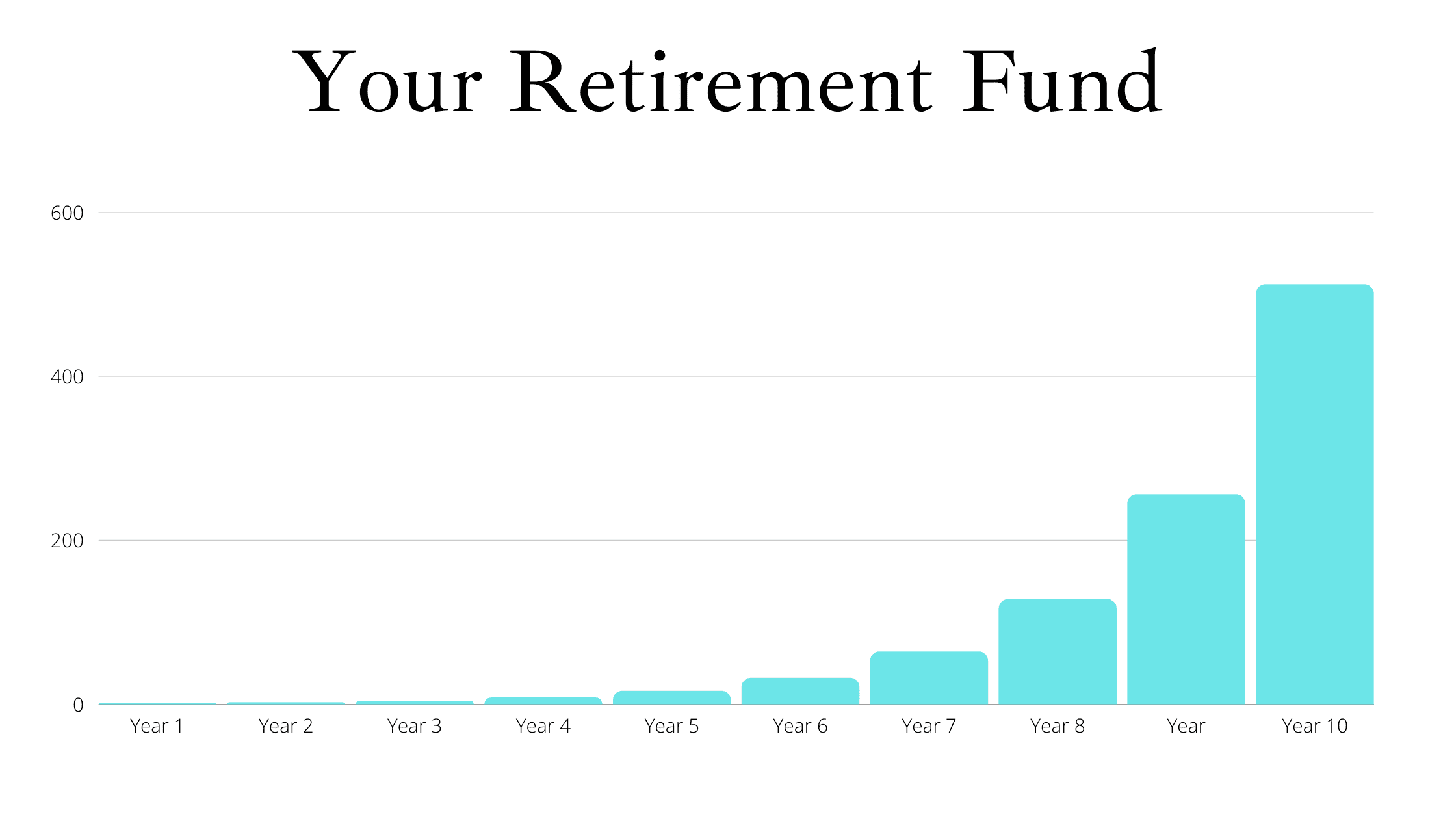

However, if you invest your money then your retirement fund will grow exponentially like this:

Here’s an example for you: Let’s pretend you’re 20 years old, you just heard about FIRE and you decide you want to retire in 20 years at age 40. Right now your income is low so you start by putting $500 a month into your basic RBC savings account which pays you 0.05% annual interest on your deposits. In 20 years, you would have about $120,600.

But, if you had invested that same $500 a month into the stock market, which historically produces 5-10% returns, in 20 years you would have between $208,000 and $380,000.

Now, let’s pretend you’ve landed a good job and are making the Canadian average income of $55,000. You’re 25 now and you’ve been living frugally for while and have this whole minimalist lifestyle down pat. You’ve managed to save 70% of your income which is $38,500 a year.

If you have 15 years left to your early retirement goal and invested 70% of your salary into the stock market, in 15 years you would be looking at about $872,000 to $1.3M based on those contributions alone. We haven’t even factored in the 5 years of modest investment contributions you made before landing your grown-up job. Once we add those in, that puts the total value of your retirement portfolio at about $1M – $1.7M.

By investing your money, your account will grow significantly larger with very little extra effort on your part. To do this, we recommend using an online broker or a robo-advisor. Using any of these options is significantly better than letting your money sit in a savings account. If you use any of these online investment services, you can expect your money to earn approximately 5-10%, which is the average return of the stock market.

These are pretty mind-blowing numbers, right? So how do you get started investing FIRE style? Most FIRE fanatics start with the two most common investment accounts in Canada; The RRSP and the TFSA.

How To Use Your RRSP To Retire Early

An RRSP provides incredible tax breaks, which makes it such a critical tool in the FIRE community. In 1957 the Government of Canada introduced the Registered Retirement Savings Plan to help more Canadians, specifically those without employer pensions, save for retirement. Contributions, aka deposits, made to your RRSP account are deducted from your gross annual income. This is intended to knock you down enough income tax brackets so that you don’t have to pay income taxes in the spring.

Ideally, you want to end up with an income tax return from the government. Those in the FIRE community use the RRSP to generate an income tax credit, or return. They then use that lump sum payment from the government to invest further. It’s genius, really. There are contribution limits, though, which are usually 18% of your total income from the previous year. Once your money is deposited within the RRSP you can invest in things like ETF’s, Stocks, Bonds and Mutual Funds and other qualified investments.

As your investments grow and generate returns, you do not have to pay capital gains on that growth. Instead, you’ll only pay taxes when you start to withdraw when it comes time to retire. As long as your investments are qualified, they are not subject to capital gains while sheltered within the RRSP. This is a popular investment account among the Canadian FIRE community.

How To Use Your TFSA To Retire Early

In a perfect world, you would be making enough money to be able to max out your RRSP and your TFSA. But for many Canadians that’s just not possible. And the RRSP offers no tax advantages for those who are already in the lowest tax bracket. So how can those with lower incomes achieve FIRE? In 2009, the Government of Canada introduced the Tax Free Savings Account to compliment the RRSP, as well as to offer more savings incentives for those with lower incomes not benefited by the RRSP tax breaks. Just like the RRSP though, deposits within the account can be invested in things like ETFs, Stocks, Bonds and Mutual Funds. The growth is not subject to capital gains tax. In fact, you don’t pay taxes on your withdrawals either, which you can do at any time.

Unlike the RRSP though, your contributions are not tax-deductible so you won’t get any tax breaks or returns when you contribute to your TFSA. The contribution room is the same for everyone, regardless of income, and is currently capped at $6,000 a year. What’s more, you can carry forward unused contribution room. It’s not a “use it or lose it” situation. That means if you’ve never had a TFSA, you could open one today and deposit $75,500 which is the amount of unused contribution room that has accumulated for you since the TFSA was created. If you did that though, you’d only be able to deposit $6,000 next year.

Most FIRE fanatics try to max out their contribution room to both accounts and invest the holdings aggressively. Canadians who do not make enough for that strategy still benefit from the tax-free investment gains. This account makes the FIRE lifestyle even more accessible to Canadians, especially those earning the average Canadian income of $55,000 a year or less.

So how do Canadians living the FIRE lifestyle get their cash into specific investment products like ETFs or Stocks? That’s where online brokers and robo-advisors come in.

Online brokers

Questrade or National Bank Direct Brokerage are good options. Once you have opened a brokerage account, simply buy index funds that will track the return of the entire stock market. To pick the best brokerage platform to invest, you can use Hardbacon’s online brokers comparison tool.

Robo-advisors

Robo advisors, such as Wealthsimple or CI Direct Investing, will invest your money for you automatically. Since they operate entirely online with no physical locations, they are able to charge minimal fees. To pick the best one, you can use Hardbacon’s Canadian robo-advisors comparison tool.

Mr. Money Mustache: a Canadian FIRE pioneer

If you are having any doubts that FIRE is an achievable dream then we’d like to share the story of Mr. Money Mustache. Mr. Money Mustache is a Canadian-born man who achieved early retirement and subsequently poured fuel onto the FIRE movement by sharing his story.

Mr. Money Mustache’s story is truly a “saving and investing” road to early retirement. He started his journey as a college grad with no student debt but also a $0 net worth. He worked several engineering jobs to start and earned around $40-$80,000 per year during the next several years (a fairly common salary). However, over the next 9 years, he was able to save enough money to retire. Here are a few of the takeaways from his journey:

Combined saving with his wife – He and his wife shared a passion for early retirement and made it a combined effort to save money. Were it not for this, it very well might have taken him 18 years to retire instead of 8.

Finding cheap living – He almost always lived with a roommate which minimized his rent bill and allowed him to save more money. He and his wife also bought a house fairly quickly after graduating and started boosting their net worth through home equity.

Investment gains – Once he had saved a significant sum, his investment gains started to add a sizable amount to his income. In later years, they would contribute $20,000+ to his net worth.

Mr. Money Mustache’s journey makes it very clear how achievable an early retirement is by simply keeping your goal at the forefront of your mind. Through simple saving and investing from a fairly standard income, he was able to retire in 9 years. With a little tweaking to his strategy, there is no reason why you can’t achieve this too!

While Mr. Money Moustache started his FIRE journey in Canada and grew his audience blogging for Canadians, he has since retired and moved to Colorado. He now blogs specifically for Americans. But don’t despair, there are other amazing Canadian FIRE bloggers and we’ve made a list of the Top 25 Best Fire Blogs in Canada, just for you.

FIRE: Setting the wheels in motion

Once you have decided what your end goal is from following the FIRE movement and have selected your preferred investment account, it’s time to get to work. Now, the challenge is saving as much money as you can each day in order to grow your retirement account as quickly as possible. Remember, you are trying to do something that takes most people 40 years in under 20 years. The exact numbers will depend on your own financial goals as well as when you start, how much you save, and when you want to retire.

Eventually, you want to have enough money saved so that you can begin to make withdrawals without depleting your account. This is known as the 4% rule.

The 4% rule is a rule of thumb that refers to the amount that you should withdraw from your retirement account every year in order to supply you with income while not depleting your nest egg. To visualize this, imagine your retirement fund as a well that is being refilled by a slow trickle of water. As long as you only take a little water each day then the well will refill overnight. However, if you start to take too much then the well won’t have time to refill and you could risk running out of water.

In 2011 Trinity University (in San Antonio, Texas) reviewed over 83 years of studies and data to determine the best rate of withdrawal from an investment portfolio. The findings concluded that for a portfolio that was invested in 75% stocks and 25% percent bonds, withdrawing 4% of the portfolio value per year would take almost 30 years to drain the account. So let’s put some numbers to that. If you had a portfolio valued at $1M, you could withdraw $40,000 a year for 25 to 30 years before you would run out of money.

In the short term, the adjustment in your lifestyle might be a challenge. However, we can assure you that the reward will be more than worth it. Or, you might not have to adjust at all if you’re already used to living frugally in order to achieve FIRE.

At first, the idea of retiring in your 30s might seem impossible. However, it has already been proven to be an achievable dream since it is something that people do all the time. The key is to create a detailed plan with your end goal in mind. If you are passionate about reaching this goal then you will find it easy to stick with your plan. Who knows, in 10 years, you might find yourself being interviewed as another success story of the FIRE Movement.

We hope that you’ve found this article valuable when it comes to understanding everything that you need to know about the FIRE movement and financial freedom in Canada. If you are interested in achieving financial independence, please download the Hardbacon app and take control of your money!