Finding a reliable bank to work with for cryptocurrency investments is important. As a Canadian, you need to know which banks will make the process seamless and which will make it a hassle. However, actively avoiding weak options should be relatively easy after reading this article, so let’s get started!

Comparing checking accounts can be daunting because you’ll have to look at many different fees and benefits associated with them; therefore, using such a guide will always be ideal, especially for beginners.

Why would I need a “crypto-friendly” bank?

If you want to invest in the cryptocurrency space and need to transfer your money to exchanges, banks won’t always be your best friend. They want you to stay and invest with them using traditional stocks and the like, so some of them will completely restrict or block cryptocurrency transactions.

By working with a bank that is known to be friendly to cryptocurrency investors, you will never have to worry about your deposits being rejected by the bank. Some of them have a strict “no cryptocurrency” policy, while others are more flexible and understanding. Using this guide will take you a lot of time, especially if this is your first time considering buying Bitcoin, Ethereum, or anything else!

11 Best Crypto-Friendly Banks in Canada

Take a look at the list below and learn more about the 11 most cryptocurrency-friendly banks in Canada. Most of them allow you to purchase cryptocurrency via bank transfer, eTransfer or even debit; and some will even let you fund your cryptocurrency exchange account using a credit card.

1. Toronto-Dominion (TD)

Perhaps the most crypto-friendly, Toronto Dominion (also known as TD Canada Trust) allows account holders to purchase cryptocurrencies via eTransfer, credit/debit transfer, and wire transfer. They have stated that they regularly ignore their policies to ensure maximum protection for their customers and TDs, and while credit purchases for cryptocurrencies have been enabled, they will be approved after manual review.

Cheapest checking account: Minimum TD Checking Account ($3.95/month + additional fees)

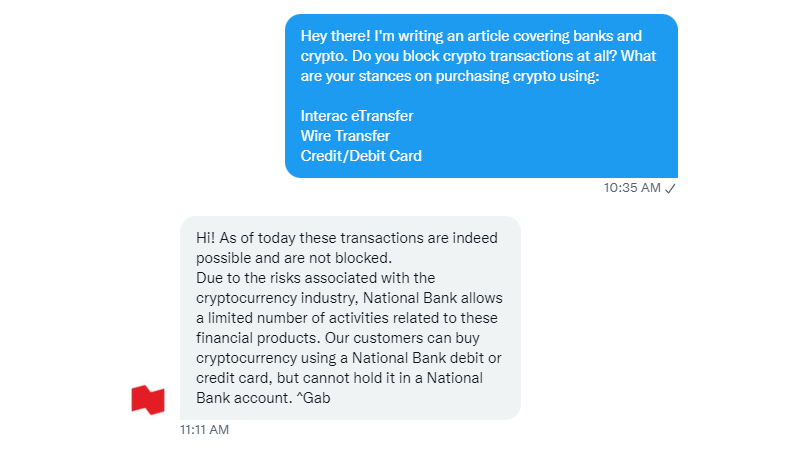

2. National Bank of Canada

The National Bank of Canada welcomes the cryptocurrency revolution with open arms as it actively enables customers to invest in cryptocurrencies using any financial services/products. This means you can fund your account on exchanges via eTransfer, bank transfer and credit/debit without fear of any holds.

National Bank is a financial institution that has been extensively involved in cryptocurrencies over the last few years and seems to want to be one of the leaders when it comes to innovation in the financial services industry.

Cheapest checking account: Minimalist ($3.95/month + additional fees)

3. The capital of the coast

Coast Capital allows clients to conveniently invest in cryptocurrencies and does not block any transactions; you can buy it via eTransfer, bank transfer, credit or debit card. Moreover, they have also shown that they are willing to innovate and work with new technologies, as they recently announced the addition of enhanced digital services through the nCino platform. Their commitment to staying flexible and adapting to customer needs is astounding and means they could become a powerhouse to watch out for in the near future!

Cheapest checking account: Personal Checking Account ($0/month)

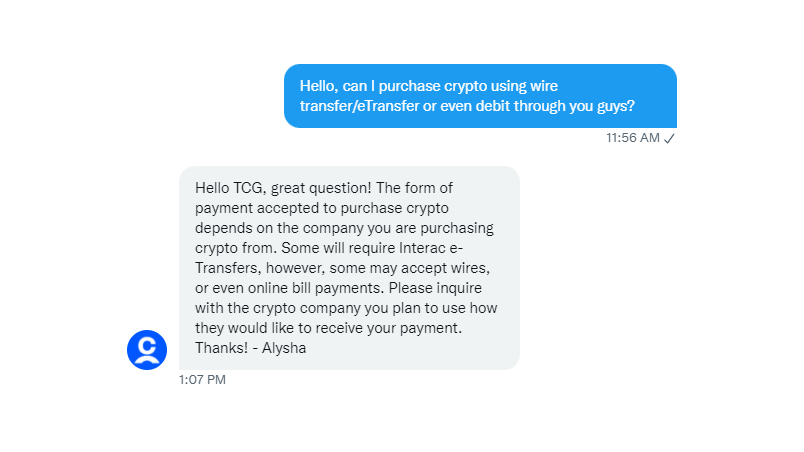

4. Canadian Imperial Bank of Commerce (CIBC)

Using a debit card is always an option for cryptocurrency transactions, but I was told that eTransfer and bank transfer are two options to explore. Some transactions will be blocked, others will be processed after verification by the official site – you cannot use the credit to purchase any crypto assets on CIBC (as usual).

Cheapest checking account: Daily Checking Account ($4.00/month + additional fees)

5. RBK

RBC (Royal Bank of Canada) allows you to purchase cryptocurrency using eTransfers and debits, but that’s all you have to work with. They recently stated that they do not allow bank transfers to cryptocurrency exchanges and also do not allow customers to use credit cards to finance their cryptocurrency investments. Most banks believe that using a credit card to finance investments in such a volatile market can be dangerous for customers, and RBC follows suit.

Cheapest checking account: Essentials ($4.00/month + additional fees)

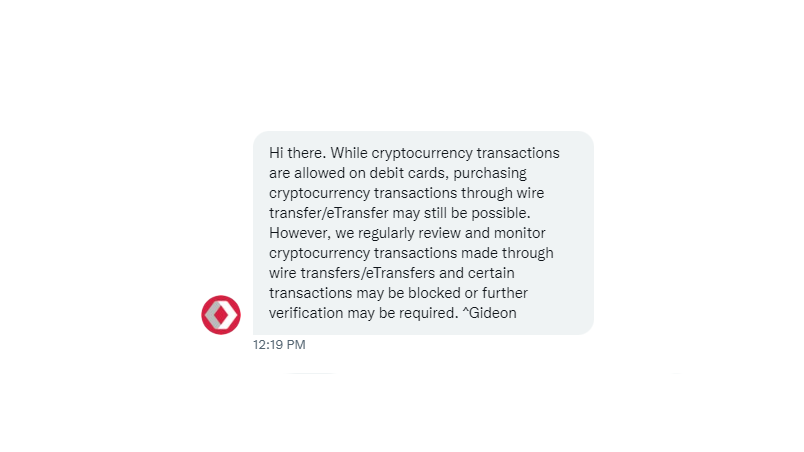

6. Scotiabank

The Bank of Nova Scotia (Scotiabank) allows you to purchase cryptocurrency via direct debit, e-transfer and wire transfer if certain prerequisites are met. If you’re trying to wire transfer money to an exchange that isn’t based in Canada, there’s a chance it will be blocked – but there are plenty of amazing Canadian cryptocurrency exchanges to choose from these days.

Cheapest checking account: Basic Bank Account ($3.95/month + additional fees)

7.ATB

ATB has supported cryptocurrency since at least 2019, and while it strives to inform its customers about the risks associated with cryptocurrency, it still allows them to transfer funds to exchanges and make purchases. They offer international bank transfers for $5.00 if the amount is less than $999.99 (everything over $1,000 is free!), as well as a Visa-enabled ATB debit card. You can also buy cryptocurrency via eTransfer as an ATB customer.

Cheapest checking account: Pay-as-you-go checks ($0/month)

8. Desjardins

Desjardins has many customers and some of them have stated that they have purchased cryptocurrency using their Desjarding account without any problems. This means you can expect to be able to purchase cryptocurrencies via bank transfer, eTransfer or debit card, but not credit card. Canadian banks, as usual, are reluctant to let people use metaphorically borrowed money to invest in high-risk assets.

Cheapest checking account: DBank Virtual Checking Account ($0/month)

9.Manulife Bank

Manulife itself has supported blockchain technology since 2016, but how does Manulife Bank handle transactions? Manulife allows customers to send wire transfers to cryptocurrency exchanges, but requires them to submit exchange information first. This is likely so that they can verify the legitimacy of the exchange, ensuring the safety of both their customers and themselves. The support agent seemed to think I wanted to buy cryptocurrencies directly from them, but it’s safe to assume you can also use direct debit and eTransfer to make purchases.

Cheapest checking account: Advantage Checking Account ($0/month)

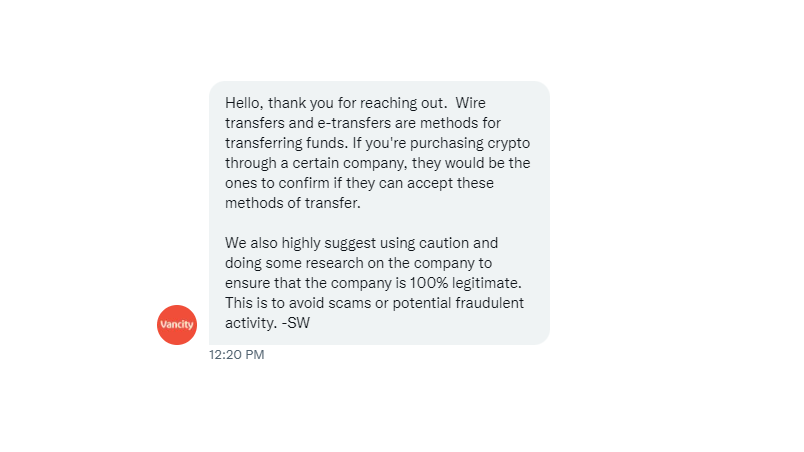

10. Vanity

Vancity also doesn’t seem to be able to handle cryptocurrency traffic, although I have a feeling the customer service representative may have been a bit confused. They offer both bank transfers and eTransfers, and it looks like they won’t block any transactions – as long as the exchange offers these options as a deposit method, you’re all set!

Cheapest checking account: Pay-as-you-go checks ($0/month)

11. BMO

Please note that most Canadian banks do not allow you to purchase cryptocurrency using credit cards. BMO allows you to purchase cryptocurrencies via direct debit or eTransfer, or even bank transfer – however, it stated that it will consider some orders “on a case-by-case basis”. You cannot purchase cryptocurrencies with a BMO credit card, and there have even been reports of BMO blocking debit cards after identifying a cryptocurrency transaction.

This means larger orders may be declined unless you call your bank first, and even then they may decline your request. In this case, it may be better to buy smaller quantities to start with.

Cheapest checking account: Practical Checking Account ($4.00/month + additional fees)

Canadian banks blocking cryptocurrency transactions

Not all banks are willing to process cryptocurrency transactions, as some either do not offer the required services (such as bank transfers or eTransfers) or simply do not support cryptocurrency purchases at all. It is a high-risk asset, but over time it becomes one of the most frequently used investment options. If you want to innovate with financial technology and don’t want any bumps in the road, here are some banks you should actively avoid.

President’s Choice Bank

President’s Choice Bank is a viable option for people who just want a checking account that offers no monthly fees, but is limited to 12 transactions (with each additional transaction costing $1.99). Moreover, they have actively stated that they are blocking all cryptocurrency transactions when it comes to PC Bank accounts.

Cheapest checking account: PC Cash Account ($0/month)

Laurentian Bank

Laurentian Bank made it difficult to figure out, but apparently it will block most cryptocurrency transactions. Attempting to purchase via Shakepay resulted in an automatic ban on the accounts of users who had tried to purchase cryptocurrencies in the past, and they did not say anything about updating their position on the matter.

If you don’t want to worry about your transactions being automatically flagged and blocked, it may be wise to move away from using Laurentian Bank for your cryptocurrency transactions.

Cheapest checking account: Minimum checking account ($4.00/month + additional fees)

Tangerine

It offers up to 0.10% interest on every dollar you hold in your account, which is a nice touch for a traditional no-fee checking account. With this in mind, Tangerine does not offer bank transfers and does not allow the use of eTransfer, credit or debit cards for cryptocurrency purchases. Therefore, you should avoid Tangerine at all costs if you want to invest in any crypto assets.

Cheapest checking account: Free Daily Checking Account ($0/month)

TD is definitely not crypto friendly anymore. Just had an etransfer blocked. When I called them, the answer was “we don’t conduct business with crypto and gambling companies”.

Kinda sucks, tbh.

Your blog has really piqued my interest on this topic. Feel free to drop by my website Webemail24 about Website Traffic.

It is always great to come across a page where the admin take an actual effort to generate a really good article. Check out my website Seoranko concerning about Lottery.

livesport808 livesport808 livesport808

livesport808 (https://northernfortplayhouse.com/)

Thanks a bunch for sharing this with all people you actually realize what you’re talking

approximately! Bookmarked. Kindly also visit my website

=). We can have a link alternate contract between us

situs bokep situs bokep situs bokep situs bokep

Thanks for the auspicious writeup. It in truth was

a leisure account it. Glance advanced to far delivered agreeable from you!

By the way, how can we be in contact?

sgcwin sgcwin sgcwin

sgcwin sgcwin

Today, I went to the beach front with my kids. I found a sea shell

and gave it to my 4 year old daughter and said

“You can hear the ocean if you put this to your ear.” She placed the shell to

her ear and screamed. There was a hermit crab inside and it

pinched her ear. She never wants to go back! LoL I know this is entirely off topic but I had to tell

someone!

alexistogel login alexistogel login alexistogel login alexistogel login alexistogel login

Very nice post. I just stumbled upon your weblog and wanted to say that I

have truly enjoyed surfing around your blog posts. In any case I’ll be subscribing to

your rss feed and I hope you write again soon!

pos4d pos4d pos4d

I loved as much as you will receive carried out right here.

The sketch is tasteful, your authored material stylish.

nonetheless, you command get got an nervousness over that

you wish be delivering the following. unwell unquestionably

come further formerly again as exactly the same nearly very often inside case you shield this hike.

hondatoto hondatoto

hondatoto

Thanks for a marvelous posting! I genuinely enjoyed reading it, you happen to be a

great author. I will make certain to bookmark your blog and will often come back at some

point. I want to encourage yourself to continue

your great writing, have a nice morning!

What fabulous ideas you have concerning this subject! By the way, check out my website at QU6 for content about Cosmetic Treatment.

jpslot jpslot jpslot

It is not my first time to pay a quick visit this site, i am

visiting this site dailly and obtain pleasant information from here every day.

It is always great to come across a page where the admin take an actual effort to generate a really good article. Check out my website QH6 concerning about Airport Transfer.

rajabandot rajabandot rajabandot

I do trust all of the ideas you have offered on your post.

They are really convincing and will definitely work.

Nonetheless, the posts are very brief for beginners.

May you please extend them a bit from subsequent time?

Thank you for the post.

preman69 preman69 preman69

Right here is the perfect site for everyone who really wants

to understand this topic. You realize a whole lot its

almost tough to argue with you (not that I actually will need to…HaHa).

You certainly put a new spin on a topic which has

been written about for a long time. Wonderful stuff, just excellent!

agen138 agen138

agen138

bookmarked!!, I love your site!

I like the valuable info you supply for your articles.

I will bookmark your weblog and test once more right here regularly.

I am rather certain I’ll be informed many new stuff proper

right here! Best of luck for the next!

I used to be able to find good info from your content.

Excellent post. I was checking continuously this blog and I’m

inspired! Extremely helpful info specially the ultimate part 🙂 I take care of such information much.

I was looking for this particular information for a

very lengthy time. Thanks and best of luck.

You actually make it seem so easy with your presentation but I find this topic to be actually

something which I think I would never understand.

It seems too complicated and very broad for me.

I am looking forward for your next post, I will try to get the hang of

it!